What to look for when buying disability insurance

Accepting that you may experience a disability during your career is an important first step in protecting your family financially. One in four people will become disabled during their career, according to the Social Security Administration.

Shopping for your safety net — disability insurance — is step number two. What should you look for? How do you know you’ll be protected? Below are answers to the three most commonly asked questions.

What are the two basic ways to buy disability insurance?

- Through your employer. Group disability insurance through your employer is typically less expensive for you than buying a private plan. Some employers cover all or a portion of the cost.

- On your own. Private disability insurance is typically based on what you do for a living, more so than your health or age. Two benefits of buying on your own policy include: your coverage is portable and benefits are tax-free.

- Unlike a group plan, if you change ministries, you can take your private disability plan with you — and eliminate a gap in coverage.

- If you paid for your insurance with after-tax dollars, the benefits you receive if you become disabled will be tax-free.

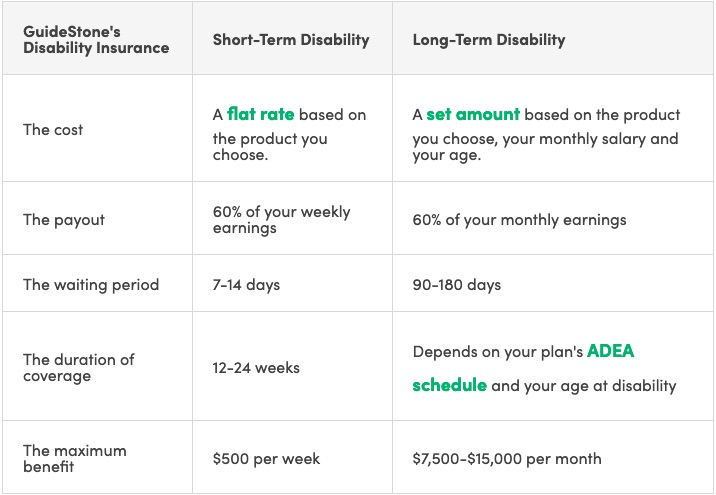

What are the main differences between short- and long-term disability insurance?

What are some important details to pay attention to?

- Own occupation vs. any occupation. You are unable to perform the duties of your own occupation due to a covered injury or illness. “Own occupation” is important because you are considered disabled if you cannot perform the duties of the occupation you held before you were disabled. “Any occupation” policies will require you to find another job that you are able to perform and will only consider you disabled if you can’t work at all.

- Elimination period. This is basically your plan’s waiting period. It’s the time between your doctor declaring you disabled and your first benefit payment. This time period will fluctuate based on the richness of your coverage. Think of your medical plan’s deductible and rate. The higher the deductible, typically the lower the rate. The longer the waiting period is for your disability benefit, typically the lower your rate will be.

- Increase in salary. Find a policy that will accept increases in your salary. Some policies will set your income level when you purchased the plan and never accept a higher level (which would mean a larger payout). Be sure to report increases in your salary promptly to ensure you receive appropriate benefits.

Originally posted on Guidestone.org